Most of the “Calculated Incidents” are conditional in nature, and will take place, only if a predetermined criterion has been met. In the C2BII program, those incidents are called “Calculated CashFlows” or CCF for short. Examples are:

- “Payment of VAT”, will take place only if there is a credit balance in the relevant account, on the relevant date.

- Calculation of “Interest Income”, will take place only if there is a debit balance in the relevant account, on the relevant date.

- Calculation of “Interest Expense”, will take place only if there is a credit balance in the relevant account, on the relevant date.

- Etc

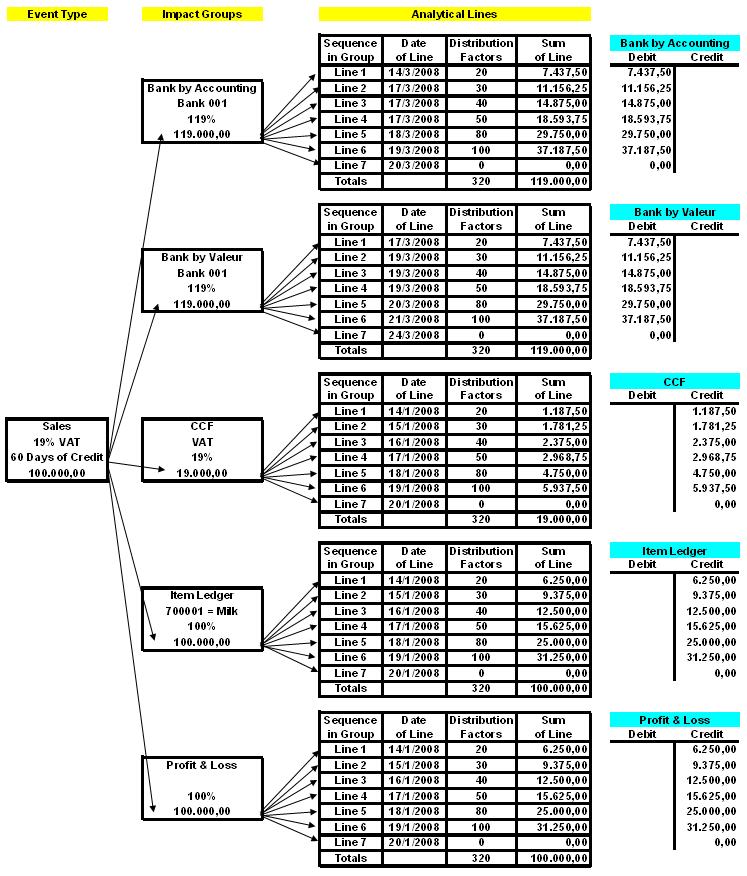

So, first of all, we must be able to create simulations of relevant accounts, on a daily basis. In previous articles, we have seen how from a forecasted incident (for example: “Forecasted Sales with 19% VAT and 60 Days of Credit to the Customer”) we have created the daily “Analytical Lines” that will populate the simulation of relevant accounts.

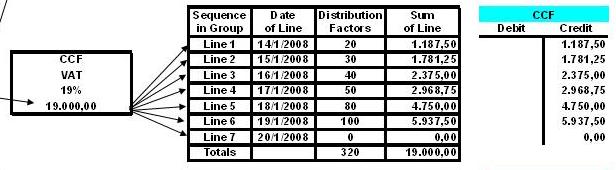

For the purposes of this article, we are going to focus on the simulation of the company’s “VAT Account” that has already been created thru the C2BII program. All Accountants know that the “VAT Account” is being debited by the values of “VAT of Purchases” and is being credited with the values of the “VAT of Sales”. On the last day of each calculation period (usually a month), in order to determine if a payment will take place, we see if the balance is a credit, and if it is, that balance gets paid to the Government on the appropriate date. In Greece, that appropriate date is the 25th of the next month.

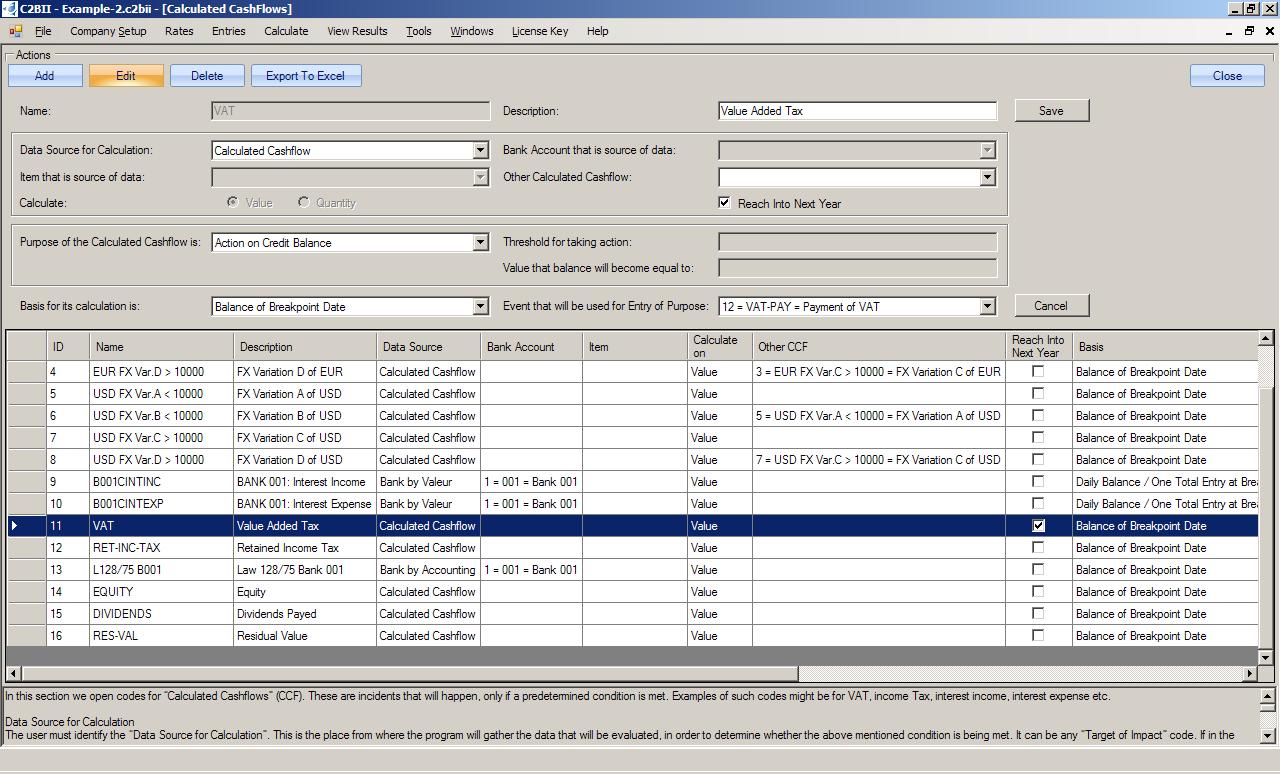

In the C2BII program, the set-up screen of the VAT looks like this:

In order to understand the chain of thoughts that are pictured, we must ask ourselves the following 6 questions:

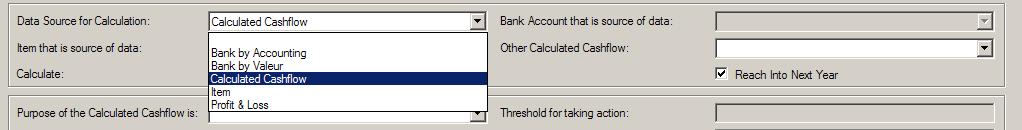

Question 1: The simulation of company’s Accounting books has many Accounts. Which is the one that is relevant to the task at hand (Payment of VAT)?

Answer 1: That information can be found in the “Data Source for Calculation”, and in this case it is the “Calculated CashFlow” Ledger. The fact that the field “Other Calculated CashFlow” is left blank, means that the source of information is itself, and not the ledger of another CCF code.

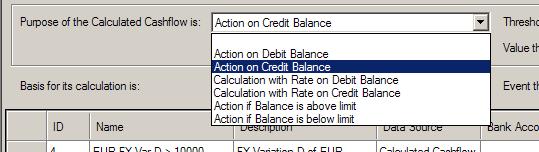

Question 2: Now that we know where to look, for data to process, we would like to know the purpose of this quest.

Answer 2: That information can be found in the “Purpose of the Calculated CashFlow”, and in this case it is to take an “Action on Credit Balance”. In other words, we will make a “VAT Payment” only if the VAT ledger satisfies the criterion of having a Credit Balance.

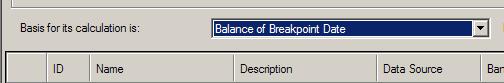

Question 3: Now that we know, where to look for data to process, and what characteristic to look for, we would like to know the value of the “Calculation Basis” for the calculation that we are going to perform.

Answer 3: That information can be found in the “Basis for its Calculation”, and in this case, it is the “Balance of the Breakpoint Date”. In Question 5, we are going to discuss the nature of the “Breakpoint Date”

Question 4: Now that we have established the value of the result of the calculation, what shall we do with it?

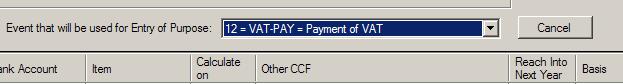

Answer 4: That information can be found in the “Event that will be used for Entry of Purpose”. It is the “Event Type” that the program will use to automatically create a new entry for the value that has been calculated. That new entry will be automatically fed into the workflow and will be processed (i.e. analyzed into relevant “Analytical Lines” that will populate the simulations of the relevant ledgers).

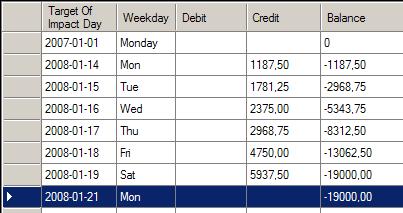

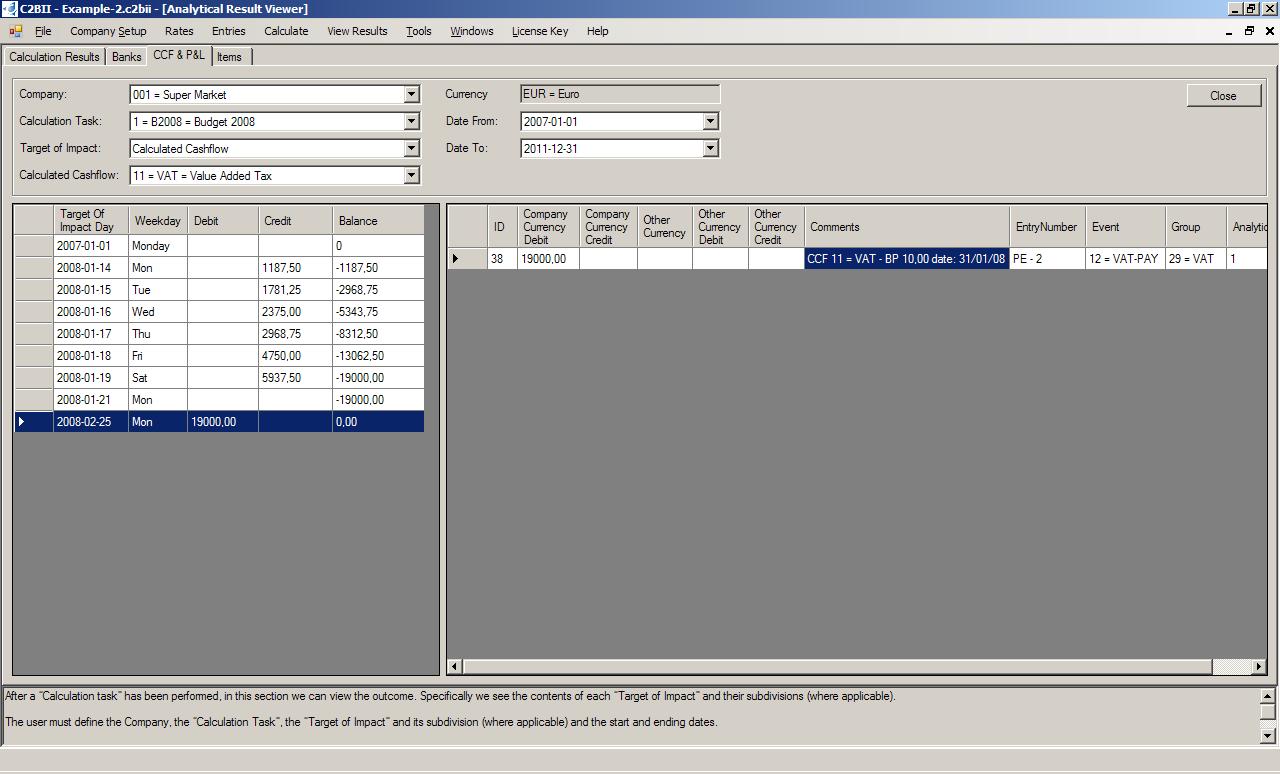

After that, the simulation of the VAT ledger will look like that:

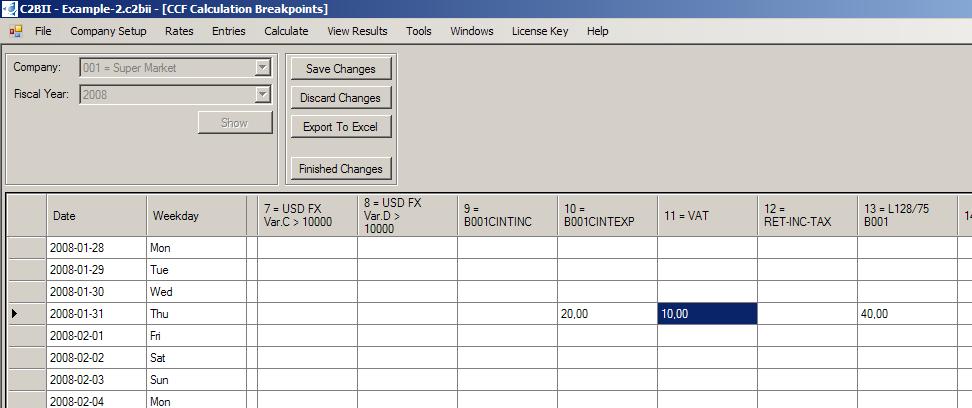

Question 5: What is the date, on which the program must automatically check if the above mentioned criterion is being met, and if it is, to create the relevant new entry?

Answer 5: That information in C2BII is called a “CCF Calculation Breakpoint” and it is being defined in another menu. On the date, on which we want that automatic check to take place, we assign a “Priority Number” to the relevant CCF. In our example, we assign “Priority Number” 10, on Jan 31 of 2008. The logic behind the creation of the “Priority Numbers” is that, if on a specific date there are more than one CCFs that need to be processed, the one with the smallest gets processed first, and the one with the largest gets processed last. In other words, this is how we make sure that actions that must take place before this calculation (prerequisites), take place in the appropriate sequence.

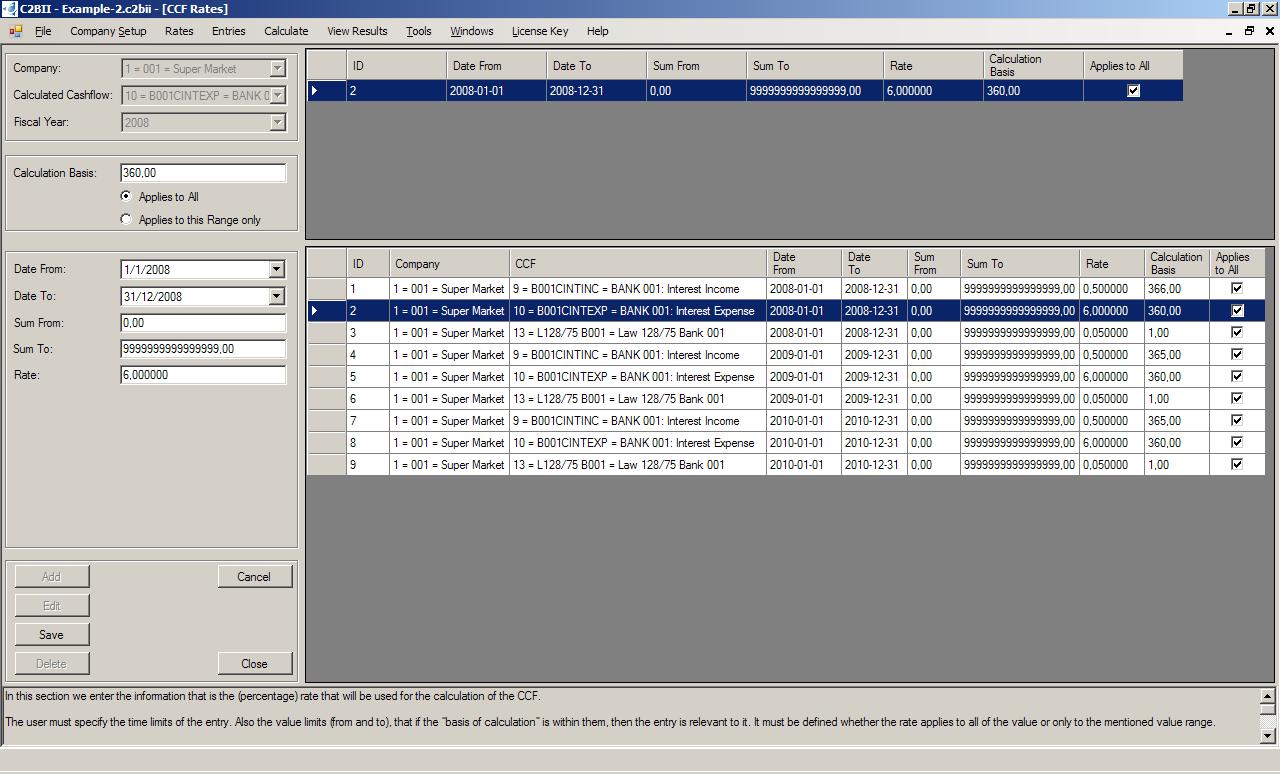

Question 6: In some types of calculations (examples: “Interest Income”, “Interest Expense”, “Income Tax” etc) a calculation rate is being involved. How do we define that?

Answer 6: That information in C2BII is called a “CCF Rate” and it is being defined in another menu.

Stick around, as we are about to find out about the mechanism that will enable us to easily and accurately process “What if” scenarios.