There is general consensus that the CashFlow calculation is the most useful Financial tool to evaluate a company, and also that it is the most important health indicator. Almost every ERP in the world has a “so-called” CashFlow module. Yet throughout the world, Financial Analysts are still doing the CashFlow on a spreadsheet. And I don’t mean some of them. I mean all of them. At first glance, that looks like a first class inefficiency. ERPs have huge capabilities to automate our work. Why do people choose not to use them?

The answer to that question is because all ERP CashFlow modules actually manage to perform less than half the work needed. Or in other words, all ERP’s are insufficient for the management of the CashFlow. In order to better understand this, imagine that we are in April, and we need to create the company’s CashFlow up to December.

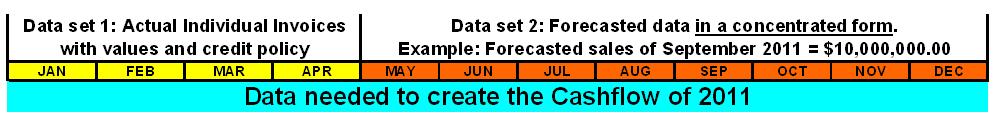

In the ERP one can find registered the actual “invoices receivable” and “invoices payable” of the company (for the period January to April), along with their actual dates and their credit policy. Based on that, the ERP can create a daily projection of the sums that are scheduled to be collected and paid, on a daily basis. So far, every ERP in the world can handle the first half of the job.

In order to reach all the way to December, we must also incorporate values (sales, purchases, expenses etc) for the period from May till December. These values have not been registered in the ERP, because they have not taken place, and so there is no invoice about them. However, their values exist in the Budgeting module, but in a concentrated form (example: Forecasted sales for September = 10 mil USD). The challenge is to process those forecasts, and derive from that concentrated form, data that are compatible with the structure of the first half of the data (daily values). This is the part where every ERP in the world, including even the global leaders, have totally failed. The required operation is very complicated, and a casual glance is not enough to reveal the number of circumstances that need to be addressed in order to arrive at a meaningful, accurate and verifiable result. Having the benefit of knowing the volume of info that is actually created by C2BII, I can tell you that it runs in the hundreds of thousands of “Analytical Lines”, and in many cases, in the millions.

And of course, there is the obvious issue that the creation of the CashFlow is only the starting point, after which we will do the really important work, which is the evaluation of the “What if” scenarios. To that end, again no ERP in the world has any meaningful tools.

These are the reasons why, on a global scale, Financial Analysts are still performing the CashFlow on a spreadsheet, using the “Monthly Average” method.

Stick around, as we are going to see a real life story, where the global leader in ERPs failed to offer anything meaningful to the CashFlow calculation needs of a company.

Pingback: A true story about SAP, its CashFlow module and its inability to process “What if” scenarios, or even get the work done Part 2 | CEO on Financial Analysis