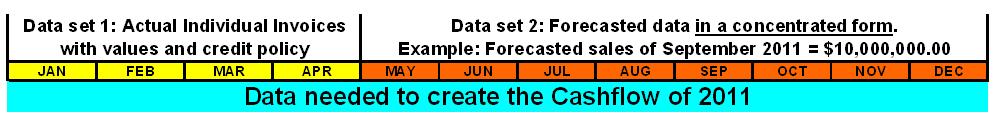

From the first half hour of the meeting, it was obvious that the CashFlow module of SAP could not handle the “What if” scenario at all. Actually, the data it could provide was only a projection of collections and payments that came as a consequence of the invoices that had already been entered in the system. The data of the forecasted values of future months were not represented at all. When asked about that, the only solution that the SAP consultants suggested, was that data from budgeted values should be manually entered by the user, into the CashFlow module.

Since I have the benefit of hindsight on that specific issue (because of C2BII), I can tell you that this amounts to hundreds of thousands (or more) of lines of data. In other words, we are talking about a volume of manual work that is unrealistic and practically impossible. I should also mention that even relatively simple calculations (like the VAT payment) had to be manually calculated and manually entered into the system. And since that is a weekly ritual, that work should be done constantly.

As you probably have guessed by now, the CashFlow module of SAP was rejected on the spot, and the company is still performing CashFlow thru spreadsheet, in the old way. The only part of it that is being used, is the one that creates the projection of the already entered invoices. That part, by its nature, and for technical calculation reasons, has a useful time horizon of “Present day plus 15 days”, or less. As soon as the first derivative payments start to kick in (for example: salaries on the 15th and the 31st, retained taxes on the 20th, VAT on the 25th, social security contributions on the 31st etc), the calculation is in need of an overhaul.

To be on the fair side, I must point out that this is not a shortcoming that is unique, and happens only in SAP. The same would have happened with any other ERP. The reason that the CashFlow modules of all ERPs are still not being used, and the work is still being done thru spreadsheet, is because a method to effectively handle all CashFlow aspects and issues didn’t exist before C2BII.

If you are an experienced Accounting & Finance professional, you probably have realized by now, that the above mentioned requirements (2 classes of collections and 2 classes of payments) represent an extremely difficult and complicated situation to calculate in a forecasted environment. How would you feel, if someone told you that if that CashFlow calculation was structured and performed thru C2BII, then the processing of the “What if” scenario would require about one minute of “keyboard punching” time, and the result would be absolutely accurate, and would incorporate all needed data (actual invoices and budgeted values)? Plus, that it could be handled, even by a person that knows little to nothing about Accounting and Finance (like a secretary)? Sounds unprecedented and revolutionary, doesn’t it?

Stick around, as we are going to finally see the new idea that is going to bring a revolution, and change for ever the world of Financial Analysis.