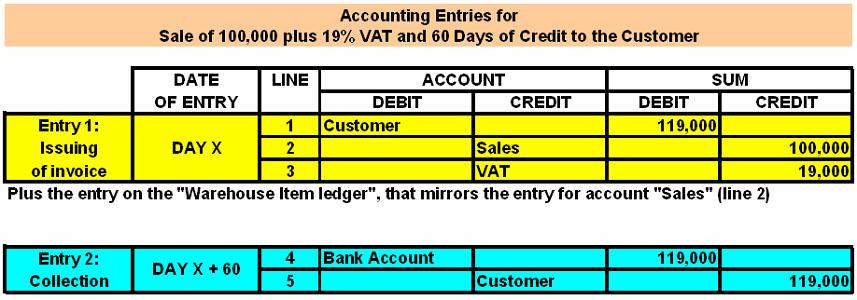

A few articles ago, we discussed about the fact that the “Double Entry bookkeeping system” has been in use for centuries to calculate “Profit & Loss”. Since we are going to tweek “Accounting 101” in order to make it able to handle data in a concentrated form, let us first see what entries would have taken place, if we were addressing individual invoices. We will work with an example of sales.

Since lines 1 and 5 cancel each other (over time), we are going to forget them and concentrate on lines 2,3 and 4, plus the entry in the “Warehouse Item Ledger” (since at Fiscal Year End we must be able to perform a valuation of “Residual Stocks of Goods” in order to establish the “Cost of Goods Sold”).

Stick around, as we are going to see how we are to see the first two levels of the three level hierarchy (Event Type – Impact Groups – Analytical Lines).